Introduction

The Reserve Bank of India (RBI) and the government give the feeling that they are not in agreement even to the extent that an understanding of their jobs is concerned. The RBI proposes that its autonomy is being violated while the government justifies its mediation as far as its concern for the economy.

RBI has 3 main roles in which it acts as an autonomous body free from the interference of the government.

- Ensuring low and stable inflation

- Ensure low & stable inflation through the autonomous conduct of monetary policy.

- Once the target is laid down by the central government, the central bank must ensure that it meets those targets with complete operational autonomy.

- Debt Management

- The RBI is the government’s debt manager

- The Debt Management function has been proposed to be hived out to an independent debt management agency but it was resisted by the central bank.

- Regulation of the banking system

- The government plays a separate role in the banking sector as the owner of public sector banks which control nearly 70 percent of all the lending.

Criticism against the nature of RBI

- The United Forum of RBI Officers in a letter to the RBI Governor had said that the employees were feeling “humiliated” by events ever since demonetization

- They alleged that the government has been impinging on the central bank’s autonomy by appointing an official for currency coordination.

- Three former governors and deputy governors flagged concerns about the central bank’s functioning.

- the central bank’s functioning.

- Even the former deputy governors, including KC Chakrabarty and Usha Thorat too have voiced their concerns.

Issues between RBI and Government

- Easing Norms of Prompt Corrective Action

- The government has asked the RBI to give exemption to power companies under the PCA framework.

- The government wants RBI to ease lending rules under PCA, as it could help reduce pressure on MSME through credit availability.

- RBI has said that such a move will jeopardize all efforts of dealing with the country’s Non-Performing Asset (NPA) Crisis.

Section 7 of the RBI Act of 1934

The government which is a stakeholder in 21 public sector banks is issuing the direction to RBI, the regulator of banks.

This section empowers the government to issue directions to RBI in the public interest.

The section states that directions must be issued after consultation with the RBI governor.

RBI Surpluses

Every year RBI earns interests from the domestic and foreign bonds it holds. This income is used in running the operation of RBI and rest is accrued as surplus. Out of this surplus, RBI holds some amount to itself as equity capital to maintain its creditworthiness and pays the rest to the government.

The government is of the opinion that RBI should pay more dividend reasons being that the building up of buffers such as the Contingency Fund and Asset Reserve by the RBI has been far in excess of what is required to maintain creditworthiness.

RBI, on the other hand, says that increasing the dividend payment to the government can prove to be inflationary as there will be more money in the market and may harm the RBI’s major task of macroeconomic stability.

The surplus is also meant to cover a situation where the rupee appreciates against one or more of the currencies or if there is a decline in the rupee value of gold.

How does RBI autonomy not affect?

- With regard to RBI Act, the Central Government might give such directions to the bank as it may from time to time, only after consultation with the Governor of the Bank, consider necessary in the public interest

- The reason behind such a clause is so that any major decisions have to be made by the government which is elected and therefore accountable to the people.

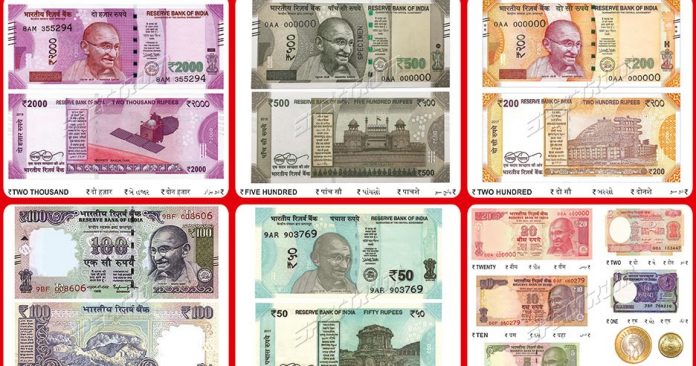

- The decision to demonetize the high-denomination currency was taken by the government in view of the public interest after consultation with the RBI

- The RBI board simply performed its duty by implementing the decision.

- The segregation of debt management from the Reserve Bank on India is not an assault on the RBI’s independence by the government.

Future Acknowledgement

Thus it is necessary that the government should respect the mandate given to RBI as a regulator of the banks. On the other hand, it must also be understood that constitutionally RBI is not independent, it is a part of the government, thus accountable to people. The independence of the central bank is maintained as it has positive externalities on the economy. Autonomy must also come with accountability. Therefore it can be said that by invoking section 7 of the RBI Act 1934, the government is acting within the power given to it under the act.

I know this site provides quality based posts and other information, is there any other web

page which offers such stuff in quality?

Thank you so much

hey everyone, I was just checkin out this site and I really like the foundation of the article, and have nothing to do, so if anyone would like to to have an enjoyable convo about it, please contact me on squidoo, my name is bruce naeire

Thank you so much

Saved as a favorite, I really like your blog!

Thank you so much

Great topic. I needs to spend some time learning more or understanding more. Thanks for fantastic info I was looking for this information for my mission.

Nice post.

Thank you for another informative site. Where else

could I get this kind of info written in such an ideal approach?

Nice post. I learn something new every day. It will always be stimulating to read content from writers. Thanks for sharing.

Welcome